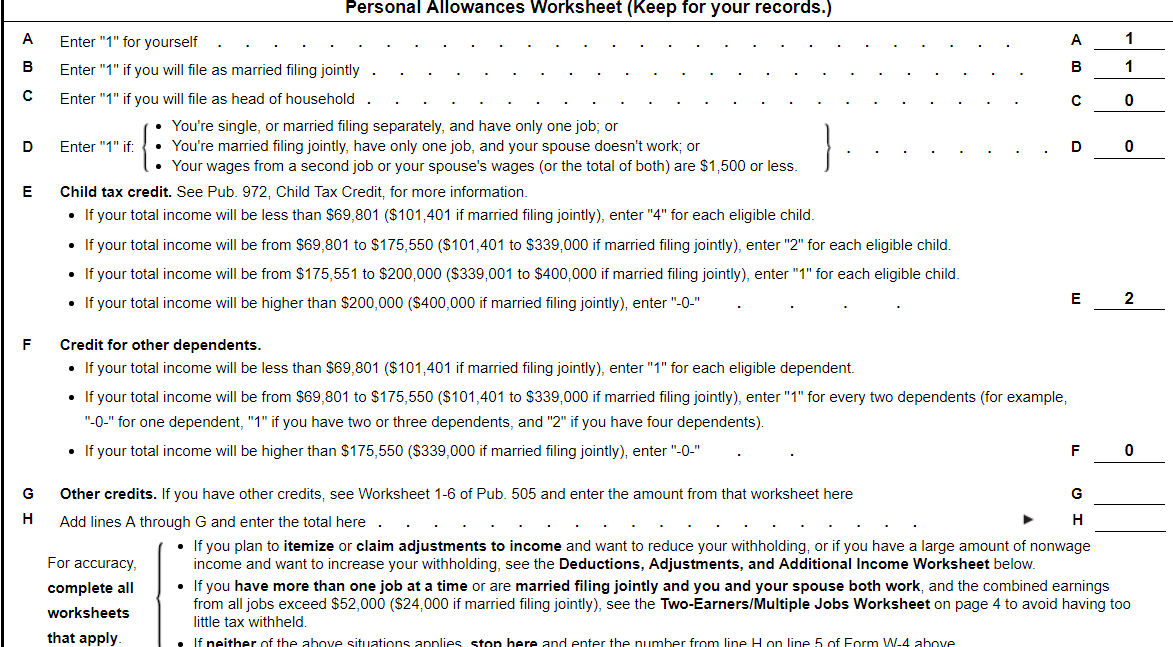

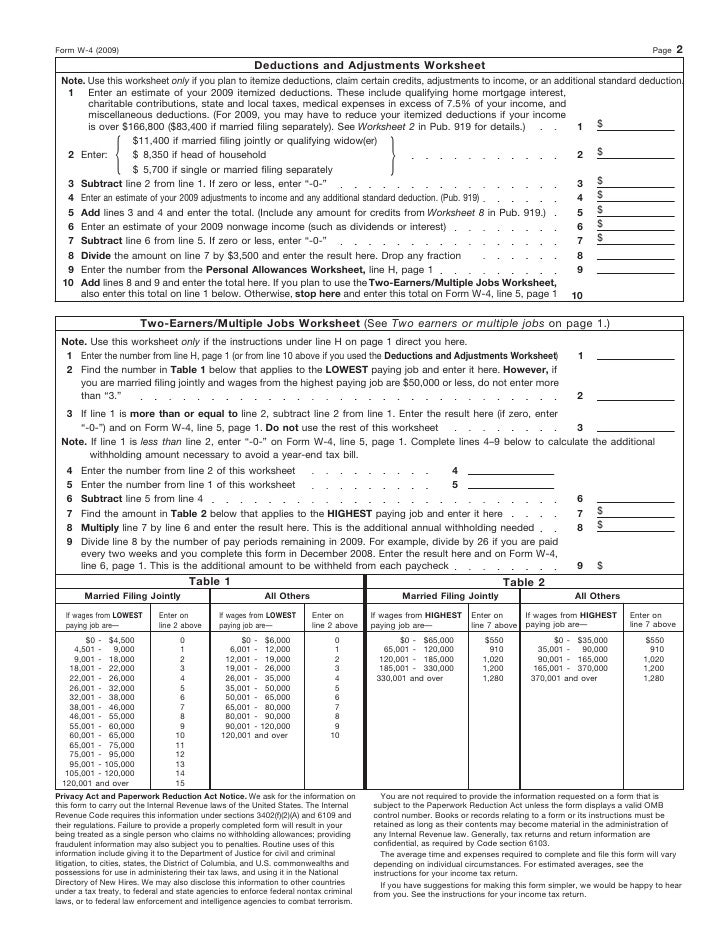

The worksheet contains a chart that shows you how many allowances you should deduct based on your incomes. If more than one job has annual wages of more than 120000 or there are more than three jobs see Pub.

This Year Is Different Revisit Your Withholding Elections Now Merriman

Download Two Earners Multiple Jobs Worksheet to Learn Multiplication Multiplication tables are a fun way to break into teaching multiplication.

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

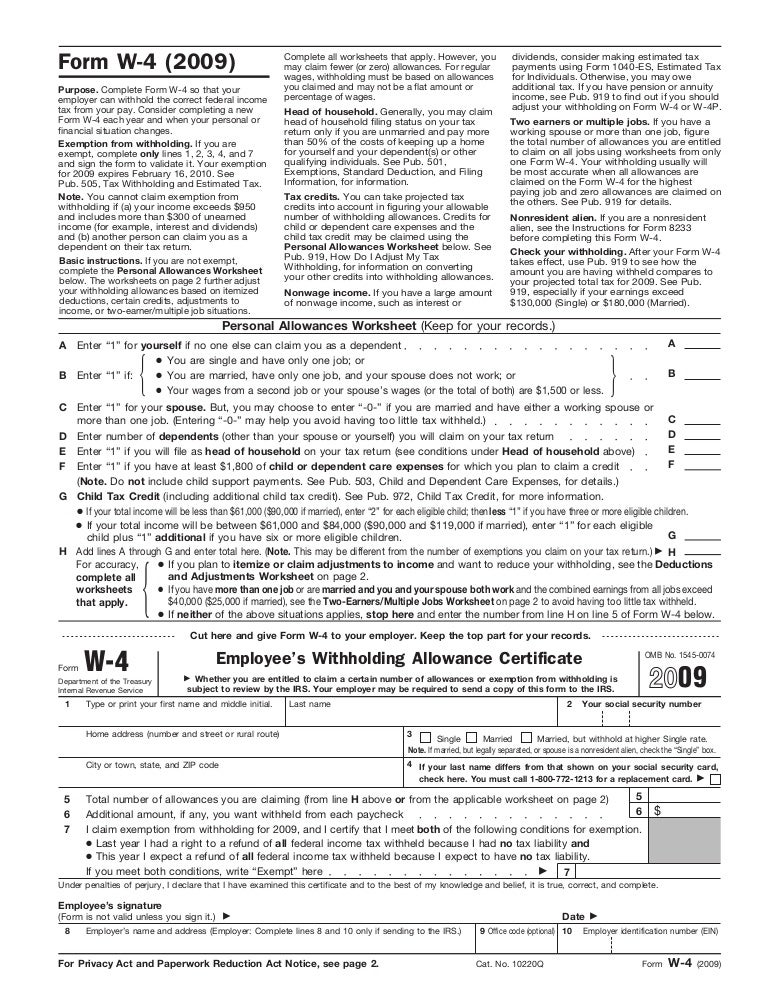

Two earners multiple jobs worksheet. 505 for additional tables. If you have a working spouse or more than one job figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Use Table 1 beneath the Two-EarnersMultiple Jobs Worksheet to find the number to enter on line 2 based on your lowest-paying job and your filing status.

Multiple Jobs or Spouse Works asks you to Complete this step if you 1 hold more than one job at a time or 2 are married filing jointly and your spouse also works If neither of. The tables give me wages but at Line 9 it asks me to divide by the rest of the pay periods left in the year. Of the worksheets for Form W-4.

The worksheets on the W-4 will help you estimate your tax liability when you have multiple jobs. Two-EarnersMultiple Jobs Worksheet Complete this worksheet if you have more than one job at a time or are married filing jointly and have a working spouse. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

Your withholding usually will be most accurate when all allowances are claimed on the Form W-4 for the highest paying job and zero allowances are claimed on the others. Or you can use the online withholding estimator at wwwirsgovW4App. However I am in a dual-earning couple so I had to move on to the final sheet.

Line 1 is for anyone who has two jobs or is filing jointly with a spouse who also works. Two earners worksheet two earners multiple jobs worksheet two earner households two earner percentage method two earners increase us household 7 teen bud worksheet from Two Earners Multiple Jobs Worksheet source. Leave travel concession Section 10 5 TaxAdda from Two Earners Multiple Jobs Worksheet source.

According to the IRS this worksheet is less accurate than the tax estimator but it provides the maximum amount of privacy. If your spouse works and you file jointly or if you have a second or third job you can use either the IRS app or the two-earnersmultiple jobs worksheet page three of the W-4 instructions to calculate how much extra should be withheld you put this amount in Step 4. If your incomes are high enough it is possible that not enough taxes will be withheld even if you claim zero allowances.

Couples should generally use the Two-EarnersMultiple Jobs Worksheet to calculate how many personal allowances to claim on the highest paying job and then claim zero allowances on all remaining jobs. The 5 times tables and other little numbers prove easier to educate most basic school individuals. To use the Two-EarnersMultiple Jobs Worksheet you must first fill out the Personal Allowances or Deductions Adjustments and Additional Income worksheets.

These worksheets account for your income credits allowable adjustments and itemized deductions. Because of this were using one worksheet as required to fill out the Two-Earners section to calculate extra withholding. If you dont complete this worksheet you might have too little tax withheld.

If youre in a dual-earning marriage or you have multiple jobs fill out the final sheet. Two earners or multiple jobs. Say you were earning 60000 annually at your old job ended November 30 and are now earning 72000 annually at your new job starting December 1st.

Multiple Jobs Worksheet. For example in 2011 if you are single and your lowest-paying job brings in 20000 enter 2. It is only necessary to calculate estimated tax liabilities for the extra income if the combined income from your two jobs exceeds 40000 as of the current year.

The Two-EarnersMultiple Jobs Worksheet does the opposite you deduct allowances. Two-EarnersMultiple Jobs Worksheet See Two earners or multiple jobs on page 1 Note. The instructions are extremely confusing for someone filling it out mid-year.

Two-EarnersMultiple Jobs Worksheet Deductions Adjustments and Additional Income Worksheet The Personal Allowances Worksheet can help. Enter the number from line H page 1 or from line 10 above if you used the Deductions and Adjustments Worksheet 1 1 2. If there are only two jobs ie you and your spouse each have a job or you have two you just check the box.

Two-EarnersMultiple Jobs Worksheet. Your HIGHEST paying job the old job should have paid about 55000 60000 per year 11 months while your LOWEST paying job the new job would pay only about 6000 this year 72000 per year 1 month. Use this worksheet only if the instructions under line H on page 1 direct you here.

If you choose option b in Step 2 you will need to complete the Multiple Jobs worksheet.

W 4 Form Complete The W 4 Form For Zachary Fox A New Chegg Com

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2021

Mastering Form W 4 The Anatomy Of A Good Withholding Number Gusto

How To Fill Out And Change Your Form W 4 Withholdings

W 4 Form How To Fill It Out In 2021

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2021

How To Fill Out And Change Your Form W 4 Withholdings

What Is Form W 4 And How To Fill It Out In 2019 Checkmark Blog

How Many Tax Allowances Should I Claim Community Tax

Form W 4 Personal Allowances Worksheet

Form W 4 How To Fill Out The New W 4 Form

Form W 4 2011 Purpose Complete Form W 4 So That Your Employer Can Withhold The Correct Federal Income Tax From Your Pay Consider Completing A New Form W 4 Each Year And When Your Personal Or Financial Situation Changes Exemption From

This Year Is Different Revisit Your Withholding Elections Now Merriman

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

This Year Is Different Revisit Your Withholding Elections Now Merriman

No comments:

Post a Comment